2023-10-01

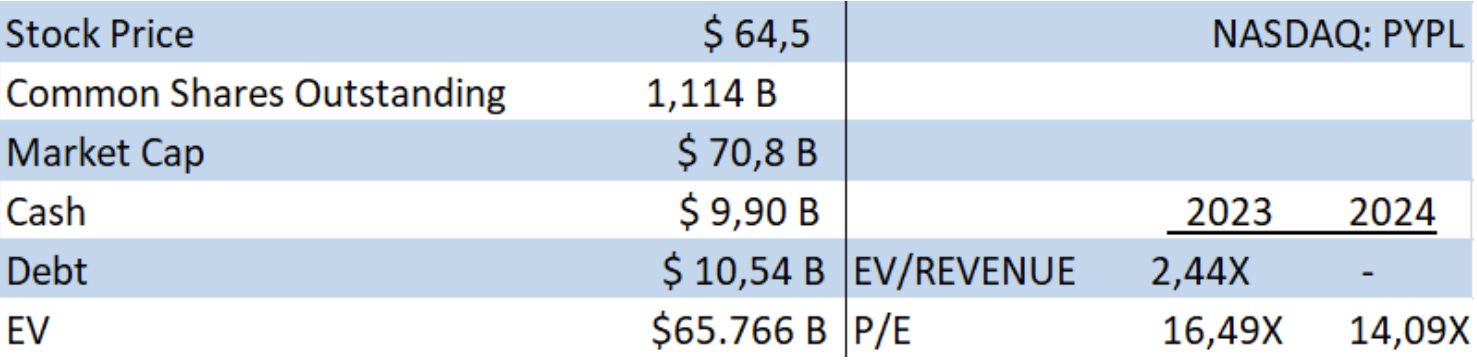

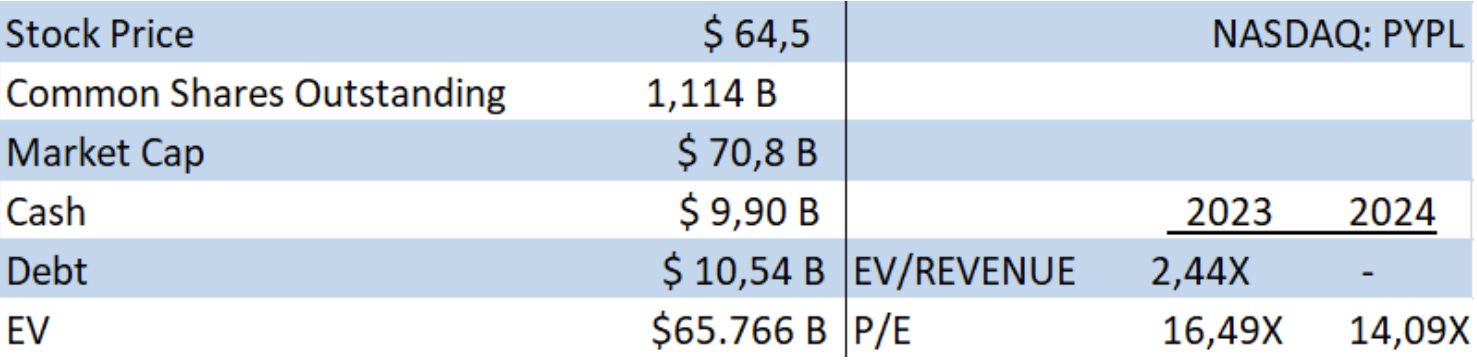

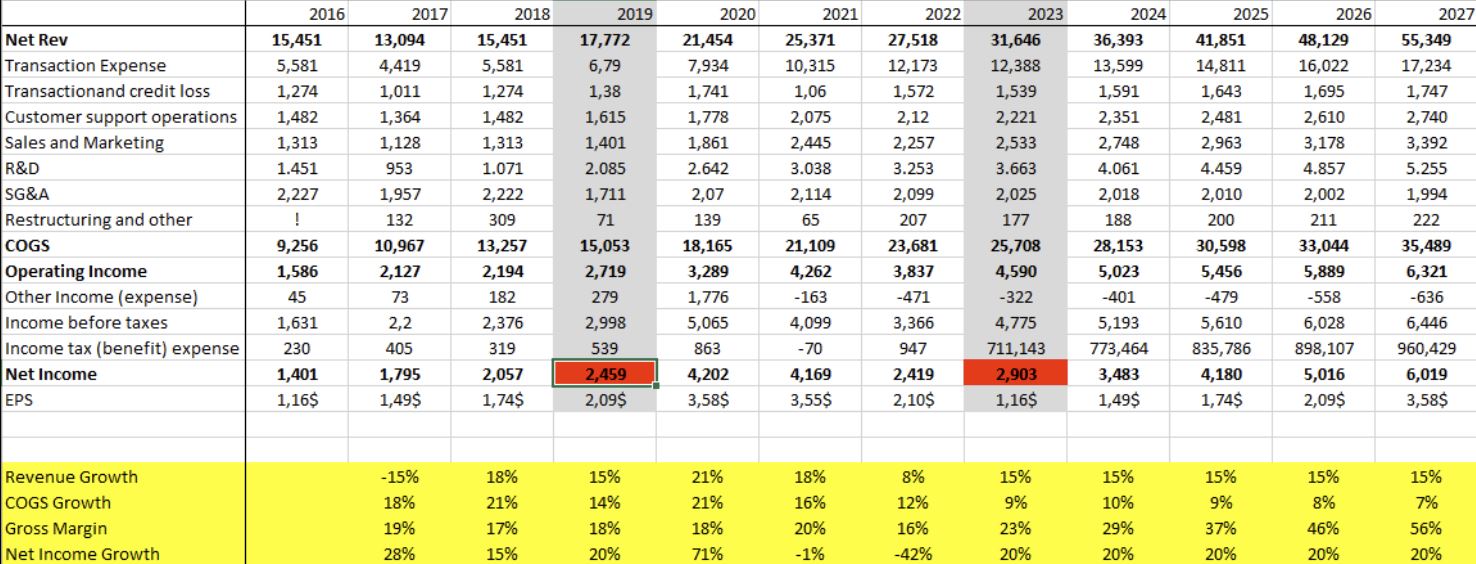

I suggest considering an investment in PayPal (NASDAQ: PYPL). In my view, the market has undervalued PayPal, evident in its current P/E ratio of 16.49X, which represents the lowest valuation in its history. I will try to write all my theses in 400 words only.

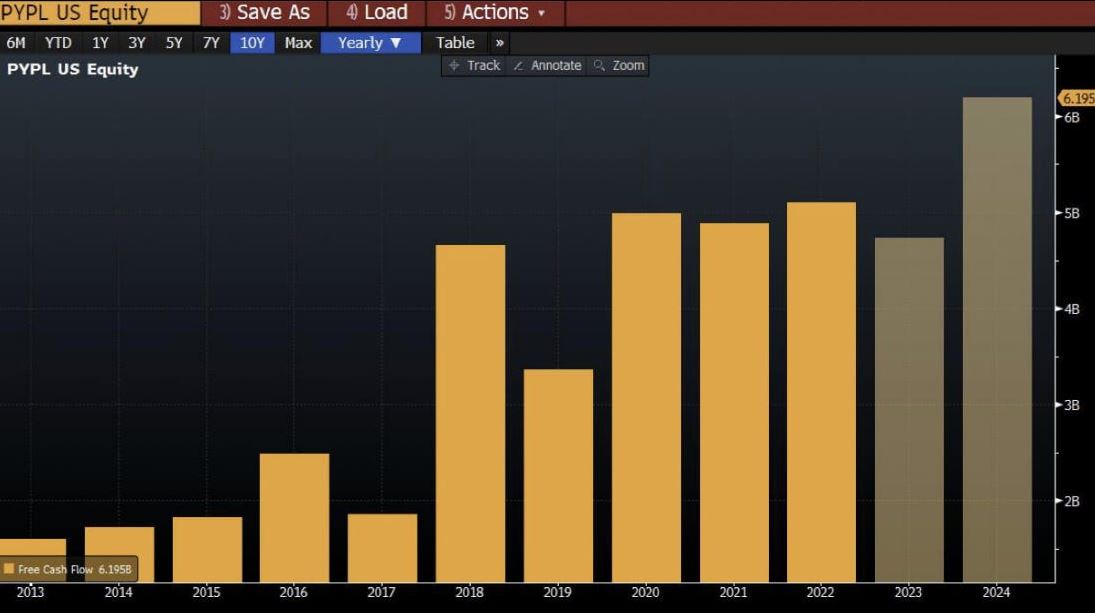

PayPal has seen an 80% decline from its 2021 highs, currently with a net income of $2.414 billion and an estimated net income of $2.903 billion for 2023. This places its net income on par with levels between 2019 and 2020. In terms of stock performance, it's similar to where it was in August 2017. On a positive note, PayPal has significantly increased its revenue by 110% from 2017 to 2022, with a 2023 estimate of $5 billion and the possibility of setting a new all-time high for Free Cash Flow (FCF) in 2024, marking a 173% increase. This translates into an appealing FCF yield of 7.28%.

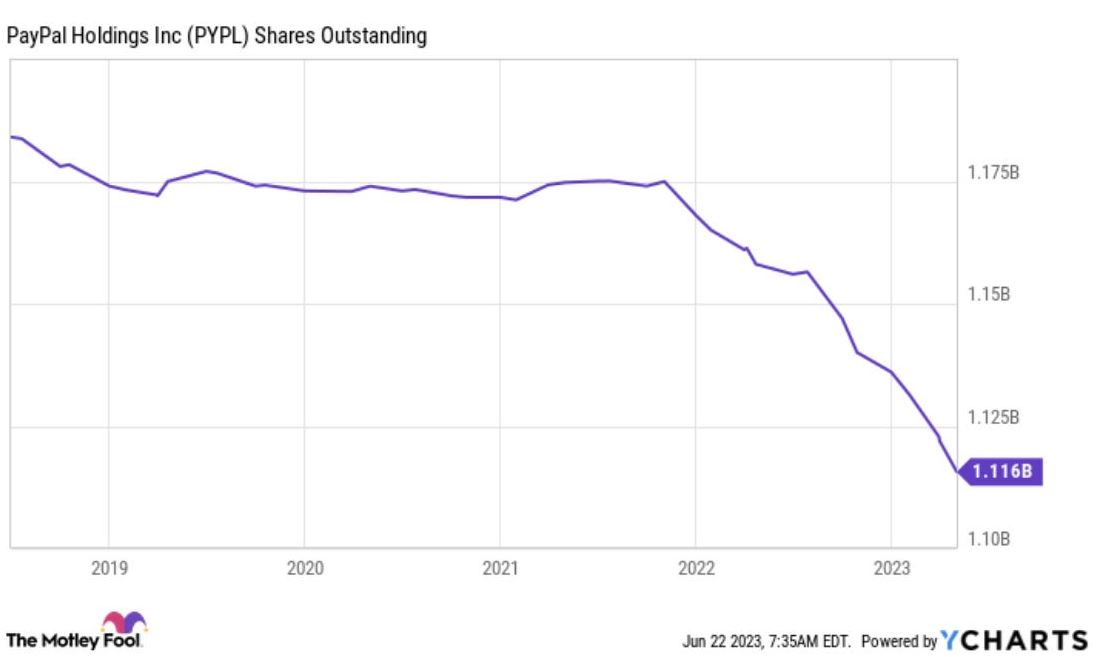

In the last quarter, PayPal sold $43 billion worth of Buy Now, Pay Later (BNPL) loans to KKR, which is expected to impact FCF positively by $1.2 billion upon the transaction's completion next quarter. This rising FCF enhances the likelihood of more substantial share buybacks. PayPal has announced a $5 billion share buyback plan for the year, having already repurchased more than 5% of its company in the past year. This trend is likely to continue in 2024, potentially reaching a buyback of 10%.

The current CEO, Daniel H Schulman, is set to resign by the end of 2023. He, along with CFO Gabrielle Scheibe, acquired a total of 26,236 shares in Q1 and September. The incoming CEO of PayPal will be Alex Chriss, known for his 19-year tenure at Intuit, specializing in technology solutions for small businesses. In January 2019, he became the Executive VP and GM for Small Businesses and SelfEmployed at Intuit. Chriss played a pivotal role in Intuit's $12 billion acquisition of Mailchimp in 2021. Under his leadership, the Small Business Segment saw remarkable growth, with annual customer and revenue increases exceeding 20% over five years.

Braintree, a subsidiary of PayPal Holdings, offers a full-stack payment platform for businesses, enabling them to handle online and mobile payments. Braintree specializes in e-commerce and mobile commerce transactions, partnering with companies like Uber, GitHub, Airbnb, and Eventbrite. While PayPal's growth was 6%, Braintree, focusing on unbranded businesses, achieved impressive 30% growth, indicating a potential source of future growth for PayPal.